Special market update – May 26, 2022

“The stock market has predicted nine of the past five recessions.” ~ Paul Samuelson

I was in Brandon, Manitoba last week for meetings. As I was driving back to Winnipeg, I remarked at how easy a drive it was. Highway 1, the Trans-Canada Highway, is a fantastically smooth road. The drive back was straightforward (straight being the optimal word). It was a pleasure compared to the chewed up, shock-testing and congested roads of Toronto. While we want our investing experience to be like Highway 1, it is more often like driving in Toronto: occasionally it leaves you feeling exhausted, stressed and never wanting to do it again. The bigger picture is the journey, however. Bumps in the road are occasionally necessary to get where we need to go. This current market environment is no exception.

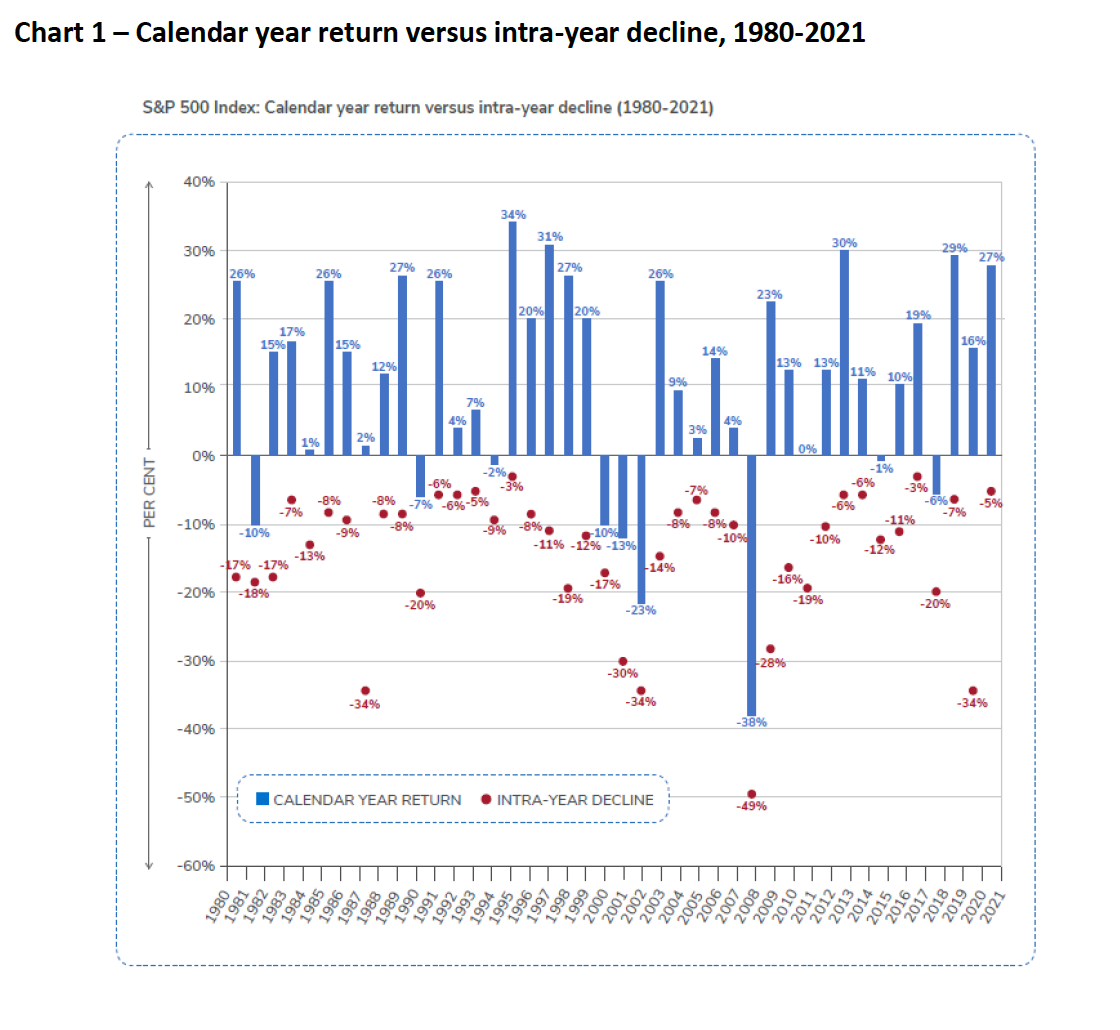

The equity market volatility that investors have been subjected to hasn’t let up through the month of May. The slide across many indices has many investors wondering if this is a precursor to recessionary conditions. The gyrations in the equity markets have no doubt been unsettling but not necessarily out of the norm. Since 1980, the S&P 500 Index has seen an average drop of -14% within the calendar year from its high. So far this year, market volatility is within the long-term average.

Corrections come in all forms and are entirely unpredictable. Looking back to the start of the year, it is easy to spot the conditions that led to the current market volatility. These include higher relative valuations of stocks, higher inflation and higher interest rates. Typically, as inflation moves higher the price-to-earnings ratio of stocks falls. But that doesn’t always translate into a market correction like we have seen this year. The last time we saw this type of market dynamic was the market correction during the fourth quarter of 2018. Ahead of that market volatility, inflation and bond yields rose, resulting in a valuation correction that saw the S&P 500 Index fall by -19.7%.

The worst of the volatility has been centered in the United States. The current market environment has seen a deep correction to the S&P 500 Index of -18.6% and to the NASDAQ Composite Index of -29.8%. Not surprisingly, U.S. equities came into the year with much higher valuations (as measured by the price-to-earnings ratio) than their global peers. The S&P/TSX Composite Index has performed much better, with a peak-to-trough return of -10.8% and a year-to-date return of -4% (as of May 24, 2022). Similarly, European equities, as measured by the Stoxx Europe 600 Index, have seen a peak-to-trough decline of -16% and a year-to-date return of -11%.

Today, as I read the financial media, there appear to be more economists calling for a U.S. recession by the end of 2022 or into 2023. The narrative goes something like this: as central banks in Canada, the United States and other countries around the world embark on their interest rate normalization to tame inflation, in other words, as interest rates go up, economies will slow to the point of recession. Could economists today be overly fixated on the half-empty glass of the economy? Let’s take a closer look.

Historically, recessions have been preceded by certain economic conditions. These are the ones that I pay attention to:

The first is the shape of the U.S. Treasury yield curve. When short-term interest rates are higher than long-term interest rates, it tends to signal economic weakness (this is when the yield curve inverts). An inverted yield curve has preceded every recession since 1970. And while we did see an inversion of the 2-year/10-year curve for three days at the beginning of April, the yield curve typically remains inverted for a period of three months before a recession. Further, we tend to see an inversion between both the 2-year/10-year curve as well as the 3-month/10-year curve: that hasn’t been the case this year.

Another sign of pending economic weakness is U.S. manufacturing output. Measured by the ISM PMI Manufacturing Index, we tend to see a contraction in advance of a recession. That is, the economy produces less, be it cars, furniture, computers and so on. This isn’t a perfect indicator: sometimes the contraction comes before a recession, sometimes after. And sometimes, like in 2015, we see manufacturing contract without an economic recession at all. Today, manufacturing continues to expand at a healthy pace, albeit slower than a year ago but still not at a level that would suggest a near-term recession.

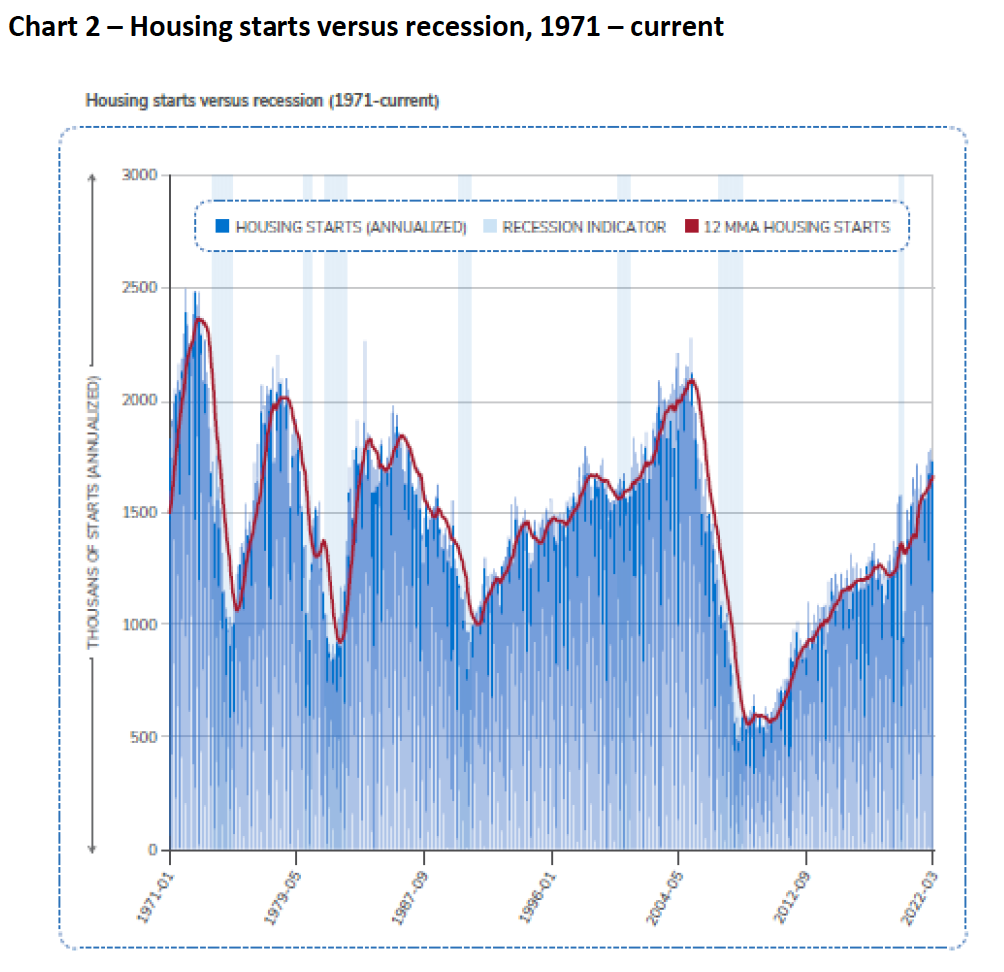

Next is residential investment, or housing starts, an important component of the U.S. economy. According to the National Association of Home Builders, building 1,000 average single-family homes creates 2,900 full-time jobs. Increasing housing starts are good for the economy. The month-over-month change in housing starts can be quite volatile due to weather and other factors, so I prefer to use the 12-month moving average of housing starts, which has been steadily increasing. There has never been a recession when housing starts are climbing on a 12-month moving average.

Lastly, the Conference Board U.S. Leading Index is an index of 10 economic variables that tend to move before changes in the overall economy. It has fallen negatively in advance of every recession going back to 1970. The index currently has a positive year-over-year reading of 4.7. Again, no evidence of a pending recession.

Finally, it is fair to say that as soon as one recession ends, we are headed towards the next one. That’s what makes an economic cycle, but the data wouldn’t suggest it’s going to happen within the next 12 months. If I’m wrong, then we’re heading into a recession unlike any we’ve seen in the last 50 years, which seems quite unlikely.

That brings us to the current market correction: could it be signalling a pending recession? In my view, the current market volatility is less a confirmation of a pending recession and more a reflection of what was an overvalued market in the face of higher inflation and higher interest rates. It is more like the correction in the fourth quarter of 2018 than the recessionary bear market of the great financial crisis.

As economist Paul Samuelson famously said, “The stock market has predicted nine of the past five recessions.” The market is notoriously bad at predicting recessions. This time feels no different.

This commentary is published by IG Wealth Management. It represents the views of our Portfolio Managers and is provided as a general source of information. It is not intended to provide investment advice or as an endorsement of any investment. Some of the securities mentioned may be owned by IG Wealth Management or its mutual funds, or by portfolios managed by our external advisors. Every effort has been made to ensure that the material contained in the commentary is accurate at the time of publication, however, IG Wealth Management cannot guarantee the accuracy or the completeness of such material and accepts no responsibility for any loss arising from any use of or reliance on the information contained herein. Commissions, fees and expenses may be associated with mutual fund investments. Read the prospectus before investing. Mutual funds are not guaranteed, values change frequently, and past performance may not be repeated.

This commentary may contain forward-looking information which reflect our or third party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of 05/26/2022. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.

© Investors Group Inc. 2022.